What You Need to Know About 105-HRA Plans for Small and Solo-Owned Businesses

In the past, we’ve talked a lot about common questions related to health insurance. One of the things we’ve covered in detail is the 105-HRA plan. This article is going to delve deeper into some of the most important questions about health insurance. However, this time we’re going to focus on answering questions that are important to small and solo-owned businesses.

We’ll talk about which steps to take for reimbursing expenses, whether Medicare tax is a cost of insurance, and who can participate in a 105-HRA, among other things. Keep reading to get the details about how the 105-HRA connects with these specific types of organizations.

What Steps Should I Take to Properly Reimburse 105-HRA Expenses?

This can be easier than expected. Let’s say you’ve hired your spouse as an employee. You also have covered them with a 105-HRA family plan. To be certain that you pass scrutiny from the IRS, there are several steps you want to take:

- Always use your business checking account to reimburse your employee-spouse for the full 100% of all medical expenses.

- Ensure that your employee-spouse submits all of their medical expense receipts to you monthly.

Now let’s say that your spouse goes to pick up their prescription medication. It was paid for using a personal credit card. There are two options for how to handle reimbursement from this point.

- The receipt can be handed off to the employee-spouse, who can submit it to your business to get proper reimbursement.

- Your employee-spouse can write a personal check for the prescription cost and hand you the canceled check and receipt for reimbursement.

In both of these situations, your business checking account can be used to reimburse your spouse for the cost of the prescription.

Can My 105-HRA Reimburse and Deduct Medicare Payments for Myself and My Spouse?

Yes! When you have access to the 105-HRA family medical plan, any supplemental insurance plans and Medicare premiums can be reimbursed by the plan. This means it will be deductible by the business.

Similar to what we just talked about in the last question, the premiums will need to be reimbursed to your employee-spouse.

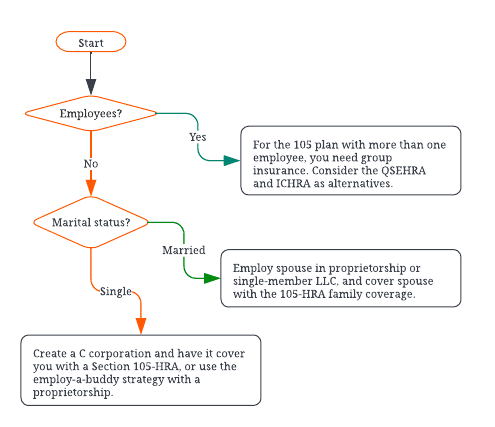

Is There a Big-Picture Flowchart for Who Can Participate in a 105-HRA?

Yes, we created one to help you out. You can view it below:

Using a buddy strategy, you (as a Schedule C taxpayer) can hire a buddy as your only employee and cover them in your 105-HRA plan. Your buddy then hires you using their proprietorship to cover you with a 105-HRA plan.

How Do 50-50 Owners of an S Corporation Find and Deduct Qualifying Insurance?

The first step you’ll want to take is to check with various health insurance companies to see if they have plans that cover you and the other shareholder as members of an S corporation.

There’s good news here regardless of what you find out when speaking with insurance providers. There’s no need to purchase group insurance. You and the other shareholder can choose to purchase individual coverage. After that, the S corporation can reimburse you based on what you pay in premiums.

This offers the same results as you would have if you chose group insurance. Below is an idea of what to expect:

- You and the other shareholder turn in expense reports with the premiums to the S corporation and are reimbursed.

- The S corporation places the reimbursements into your W2s in box one rather than box three or box five.

- You and the other shareholder deduce the premiums as self-employed health insurance on Schedule 1 of Form 1040 if your box five wages are more than the cost of insurance and you qualify for the deduction.

How Do Spouses Who Operate a 50-50 LLC Deduct Health Insurance for the Employee-Spouse?

Are you in a community property state? If so, you can choose to treat the partnership LLC as a single-member LLC simply by residing in the location you do.

After you move forward with single-member LLC status, there are other steps you’ll need to take. Hire the employee-spouse as your only employee and you can easily cover that person using your own family 105-HRA plan.

If you don’t live and run your business in a community property state, the process will be different. Instead, you need to end the multi-person LLC and choose to operate as a sole proprietorship or a single-member LLC.

Can I Consider the Medicare Tax as a Cost of Insurance for the 105-HRA Plan?

Unfortunately, the answer to this question is no. It might seem logical that you could use your Medicare tax as a cost of insurance but it does not work that way. Tax law is very complicated and nuanced and includes information about whether this is possible or not. Medicare taxes are included in your W2 but these are not considered a payment associated with your health insurance. It’s a tax and you are required to pay it.

Takeaways

If you have a 105-HRA family plan, you can reimburse your employee-spouse for 100% of the family medical expenses using your business checking account. Once that’s done, your spouse can make requests for reimbursement every month.

For other information about how the 105-HRA plan works, use the flowchart earlier in this article.

Owners of S corporations can buy individual health insurance coverage and have the corporation reimburse them for premiums. These will be reported in box one of the W2, rather than box three or five.

In community property states, you and your spouse can treat your partnership LLC as a single-person LLC. This means you can hire your spouse as an employee and cover them on your family 105-HRA plan.

Medicare taxes taken from your W2 are not health insurance payments and can’t be reimbursed the same way by an S corporation. To learn more, take a look at the Blueprint for Employee-Spouse 105-HRA (Health Reimbursement Arrangement).